Are you keeping your estate plan up to date after a move?

About the Episode:

•Legal implications of moving between states and estate planning

•Planning for loved ones with disabilities while preserving government benefits

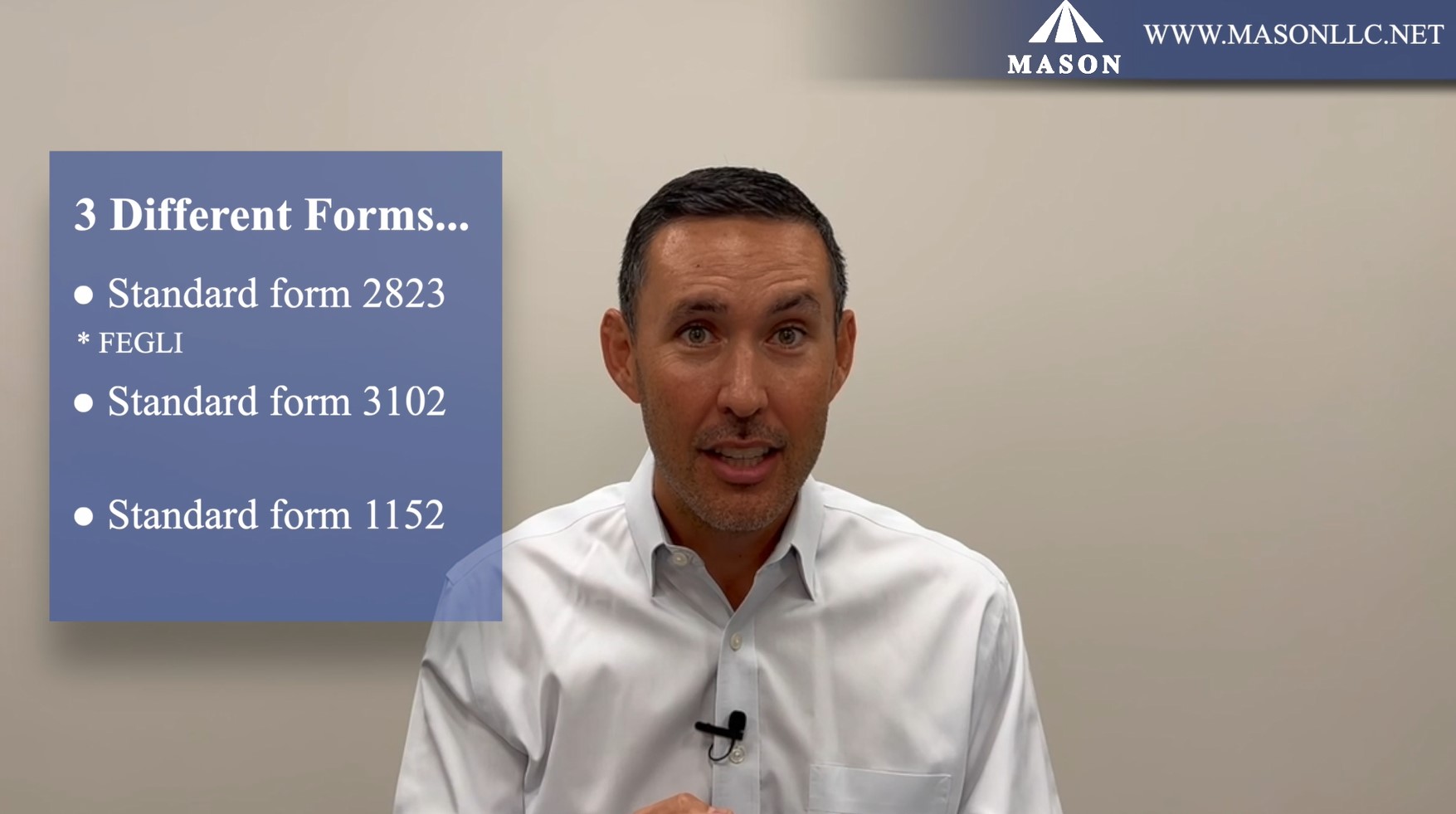

•Critical estate documents: wills, powers of attorney, and inheritance tax planning

View More

About the Episode:

•Legal implications of moving between states and estate planning

•Planning for loved ones with disabilities while preserving government benefits

•Critical estate documents: wills, powers of attorney, and inheritance tax planning

.png)