1099’s, W-2’s, and other tax documents are arriving on a daily basis. Our goal is to minimize the stress associated with tax season. The tax strategies implemented by Mason & Associates are well thought out and designed to help clients achieve specific financial planning goals. At times, these strategies involve a significant repositioning of assets and are designed to either increase or decrease taxable income. The strategies implemented in 2019 should not result in unwanted repercussions. The following information will assist you in preparing for tax season and provide guidance on how to interact with your CPA or tax professional. Please contact us if you or your tax professional have questions on the strategies that were implemented in 2019.

Mason & Associates Rolls Out New Tax Planning and Research Software

Tommy Blackburn, CFP®, CPA, PFS joined Mason & Associates in July of 2019. Tommy’s extensive background as a CPA and CFP® has proven extremely valuable in the six months that he’s been a part of our team. Since he joined, we have researched and implemented new tax research software and new tax planning software. The tax research software is an extensive database that provides the Mason advisors with a user friendly interface to quickly research complicated questions as well as the ability to cite specific sections of the tax code to confirm our recommendations.

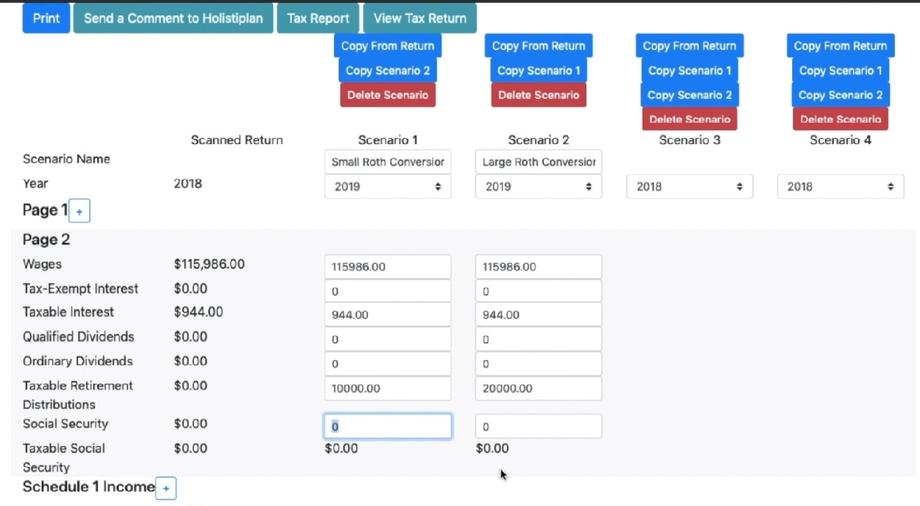

We are most excited about our new ability to run multi-year tax projections to incorporate our Roth conversion and charitable giving strategies. Holistiplan, winner of the XYPN FinTech Competition, has become a critical piece of software that provides us the ability to better serve you.

DO NOT RUSH TO FILE YOUR FEDERAL OR STATE TAXES

We recommend filing federal and state returns after February 15th. Although most tax documents will be received by January 31, certain documents are commonly corrected or amended after January 31st. 1099’s associated with non-retirement accounts (Individual, Joint, and Trust) are commonly amended in February. In addition, Schedule K-1’s are typically issued after March 15th, and sometimes they are issued as late as September, 15th. If your investments, rental property, or trust generates a Schedule K-1, please make sure to delay filing until receipt of this document.

Long Term Care Premium Deduction

Please remember to inform your tax professional of long term care insurance premiums paid in 2019. The premiums are deductible on either your federal or Virginia tax return but not both. It is rare that LTC premiums will be deductible on the federal return due to the fact that most clients are taking the Standard Deduction. In addition, those who do itemize on their Federal tax return must have medical expenses in excess of 7.5% of Adjusted Gross Income to receive any benefit from the long term care premiums paid. It is more common for our clients to be able to deduct long term care premiums on the Virginia Tax return using Schedule ADJ and Code 106. Please review your 2018 Virginia return to determine if the deduction was claimed. If the deduction was not claimed, consider amending the return if the benefit of the deduction is higher than the cost to prepare the amendment.

Virginia Tax Savings = Long Term Care Premiums x 5.75%

TSP, 401(k) and IRA Rollovers in 2019

Many clients completed one or more rollovers or transfers in 2019. Transfers from an employer retirement plan (TSP, 401k, 403b) will generate a 1099-R that documents the transfer. Box 7 of the 1099-R should have code “G” which indicates a non-taxable, institution to institution rollover.

The majority of the rollovers and transfers executed by Mason & Associates are direct rollovers from an employer plan to an IRA or from an IRA to an IRA. Although direct transfers are the most common, a handful of indirect transfers are processed annually. Indirect transfers occur when a taxpayer takes possession of retirement funds and then transfers those funds to an eligible account within 60 days (60 day rollover). The 1099-R generated for this transaction will indicate a Gross Distribution of X and a Taxable Distribution of X. It is the responsibility of the taxpayer or tax professional to properly report the 60 day rollover to avoid any taxes or penalty associated with the transfer. Please note that taxpayers are allowed one 60 day rollover per 12 month period. 60 day rollovers are rare at Mason but typically occur when:

- Extracting tax exempt contributions from a Uniformed Service TSP.

- Extracting after tax contributions from a 401(k).

- Transferring retirement funds from an account held at a bank or credit union.

Please don’t hesitate to contact us if you have questions in reference to a rollover or transfer that was completed in 2019.

Contribute to Traditional IRA and Convert to Roth IRA

Mason & Associates has implemented this strategy since 2010. The contribution and conversion strategy is designed for families with an Adjusted Gross Income above $193,000 in 2019 (married filing jointly). The strategy involves contributing to a non-deductible IRA and then converting the IRA to a Roth IRA. Clients using this strategy execute the contribution and conversion on an annual basis. The conversion from IRA to Roth IRA will generate a 1099-R and report the conversion as a taxable distribution in the year that the conversion occurred. However, because clients did not deduct the IRA contribution, the conversion to Roth is a conversion of after-tax dollars which results in a tax free conversion. Custodians do not have the ability to verify who can and cannot deduct an IRA contribution. Therefore, it is the responsibility of the taxpayer and tax professional to report the transactions correctly using IRS form 8606. Please do not use this strategy without our supervision and keep us informed if you have previously used this strategy with another advisor. This advanced planning strategy is ideal for clients who are not able to contribute directly to a Roth IRA due to their income being too high.

Employer Retirement Plan Contribution Limits

Retirement plan contribution limits have increased for tax year 2020.

- Thrift Savings Plan

- $19,500 (younger than age 50)

- $26,000 (Age 50 or older)

- 401(k), 403(b), and most 457’s

- $19,500 (younger than age 50)

- $26,000 (Age 50 or older)

IRA Contribution Limits

IRA contribution limits remain unchanged for tax year 2020.

- $6,000 if under age 50

- $7,000 if age 50 or older

HSA Contribution Limits

Health savings accounts are available for those who are enrolled in high deductible health plans. If enrolled in a high deductible health plan, consider funding a Health Savings Account (HSA) to the maximum level. Contributions to an HSA are tax deductible and the growth is tax free if distributed for qualified medical expenses. Mason & Associates frequently recommends the investing of HSA contributions rather than parking the HSA contributions in a cash position. HSA providers typically require a minimum cash balance of $1,000-$2,000 and allow participants to invest dollars in excess of the minimum cash balance requirement. The Mason and Associates recommendation to invest HSA balances are client and plan specific. The recommendation is based on the client having an adequate emergency fund and the ability to pay for deductibles and out of pocket maximums from another source. For tax year 2020, the limits are:

- $3,550 single

- $7,100 family

- $1,000 catch up contribution per person age 55 or older

Voluntary Contribution Plan (VCP)

CSRS and CSRS Offset clients who completed a VCP to Roth IRA transfer should not be alarmed if your tax preparer is unfamiliar with the process. Most tax professionals have not encountered this planning strategy because it is unique and only available to CSRS and CSRS Offset employees. Please have your tax professional contact us with any questions related to this transaction.

Qualified Charitable Distribution

Although this strategy is becoming more popular, it is still often overlooked by many financial planners and taxpayers. Qualified Charitable Distributions (QCD) allow a taxpayer, who is age 70.5 or older, to send distributions directly from an IRA to a charity. The result is a non-taxable retirement distribution from a taxable IRA!

Qualified Charitable Distributions can satisfy Required Minimum Distributions up to $100,000. Please note that it is not required that 100% of your Required Distribution be sent to charity. Taxpayers are also able to gift more than their required minimum distribution up to the $100,000 limit. This is a highly effective and efficient way to give. The SECURE Act delays required minimum distributions to age 72 for those who did not have an RMD in 2019. However it does not eliminate their ability to begin the QCD strategy at age 70.5.

Unfortunately, IRA custodians are not able to verify that all distributions were actually sent to qualified charities. Thus, a 1099-R will be generated reporting the distribution as taxable to the owner of the IRA, and the responsibility to report this correctly falls on the taxpayer and the tax professional. Please be sure to inform your tax professional, or software if you self-prepare, if you made a QCD(s) in 2019.

Radio Show 1st Quarter 2020

Tune in the 1st and 3rd Tuesday of each month from 6:00-7:00p on AM 790 WNIS or stream here. Topics will vary but will be focusing on Roth Conversions, Charitable Giving Strategies, and planning around the sunset of the current tax code in 2025.

Thank you for being part of the Mason & Associates team. We are excited about 2020, and we look forward to continuing to customize your financial plan to better achieve your financial planning goals.