-

Don’t Let the Government Control Your Tax Plan! Take Action Today!

John Mason, CFP®, discusses the importance of planning TODAY to control your tax bill in the future. About the Episode: • Your future tax rate is unknown. • However, this…

- Blogs

- Economy & Investments

- Economy & Investments

- Economy & Investments

- Estate, Legacy & Life Events

- Estate, Legacy & Life Events

- Federal Retirement Planning

- Federal Retirement Planning

- Financial Planning Foundations

- Financial Planning Foundations

- Financial Planning Foundations

- Life insurance (FEGLI) & LTC

- Life insurance (FEGLI) & LTC

- Life insurance (FEGLI) & LTC

- Medicare, FEHB & Tricare

- Medicare, FEHB & Tricare

- Planning Your Federal Retirement

- Podcast

- Secret Millionaire- the value of federal benefits

- Secret Millionaire- the value of federal benefits

- Social Security

- Survivor Benefits

- Survivor Benefits

- Survivor Benefits

- Tax Planning

- Tax Planning

- Tax Planning

- Thrift Savings Plan

- Thrift Savings Plan

- Videos

-

TSP Distributions Demystified – Know the Tax Consequences Today!

Ben Raikes, CFP®, EA, of Mason & Associates discusses the methods in which funds can be distributed from TSP and…

-

Federal Employees – Beware the FERS Retirement Gap!

John Mason, CFP®, discusses the FERS Retirement Gap and how the sometimes lengthy adjudication process can impact your financial plan.…

-

The FERS Supplement – Everything You Need to Know!

John Mason, CFP®, reviews the FERS Supplement and how this additional income can benefit Federal Employees. About the Episode: •…

-

Federal Employees – DO NOT Decline Survivor Benefits!

John Mason, CFP®, reviews the pitfalls of declining survivor benefits and the true cost of this choice to your financial…

-

Thrift Savings Plan Options – Are Lifecycle Funds Right for You?

Ben Raikes, CFP®, EA, of Mason & Associates discusses the investments within the TSP. Specifically, the Lifecycle funds and their…

-

Estate Planning Mini-Series – What is a Revocable Trust?

Tommy Blackburn, CFP®, CPA, PFS, of Mason & Associates reviews the basics of revocable trusts and how they can be…

-

COLA Danger – Your Cost of Living Adjustment May be Delayed !

Tommy Blackburn, CFP®, CPA, PFS, of Mason & Associates reviews Federal pension cost of living adjustments (COLAs) and situations in…

-

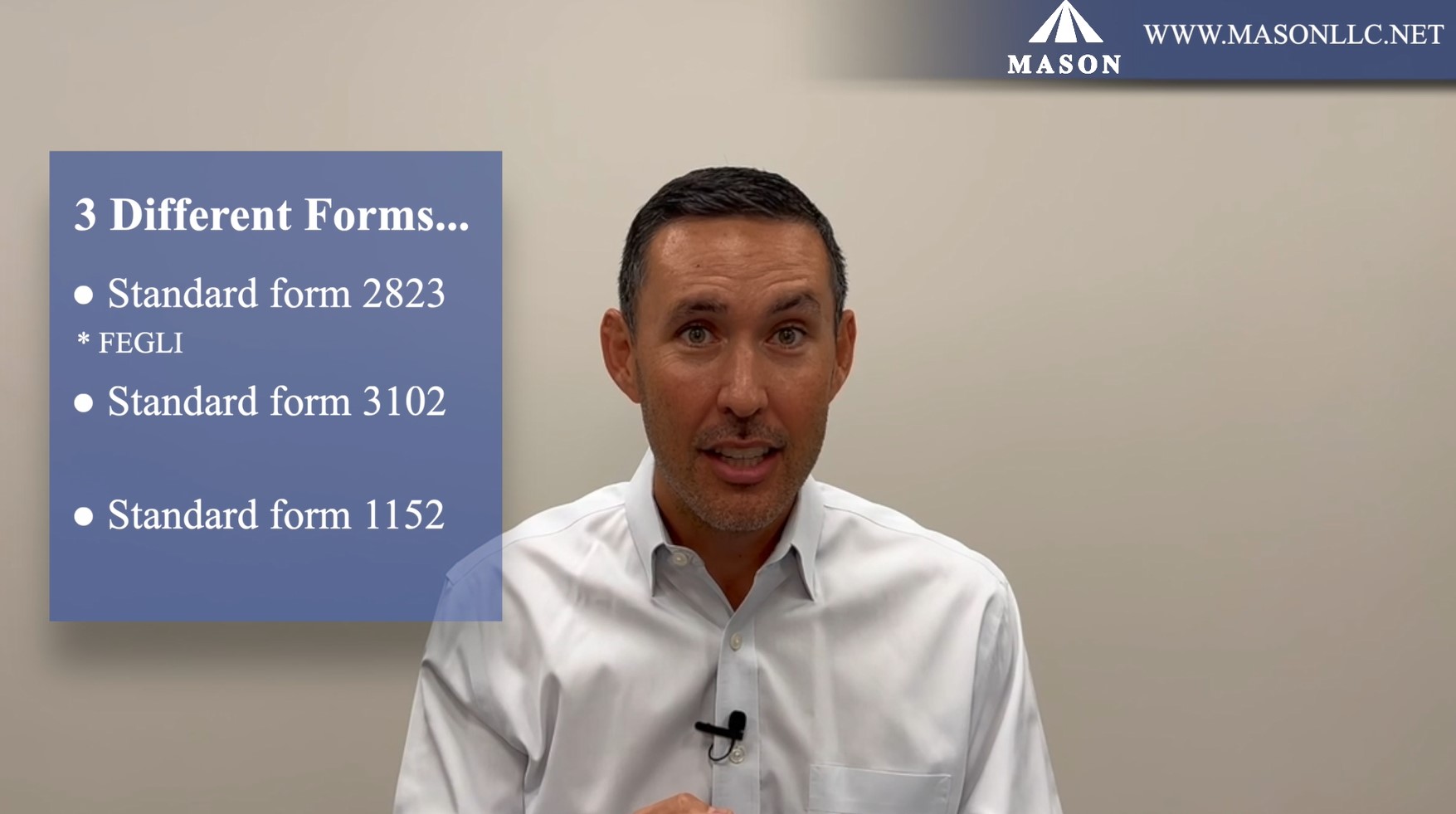

What Beneficiary Form!?

John Mason, CFP®, discusses the need for Federal employees to understand beneficiary forms that may have been completed decades ago.…

-

Roth TSP or Traditional TSP? Which is Best for Federal Employees?

John Mason, CFP®, discusses the differences between traditional (pre-tax) retirement savings and Roth retirement savings. About the Episode: • There…